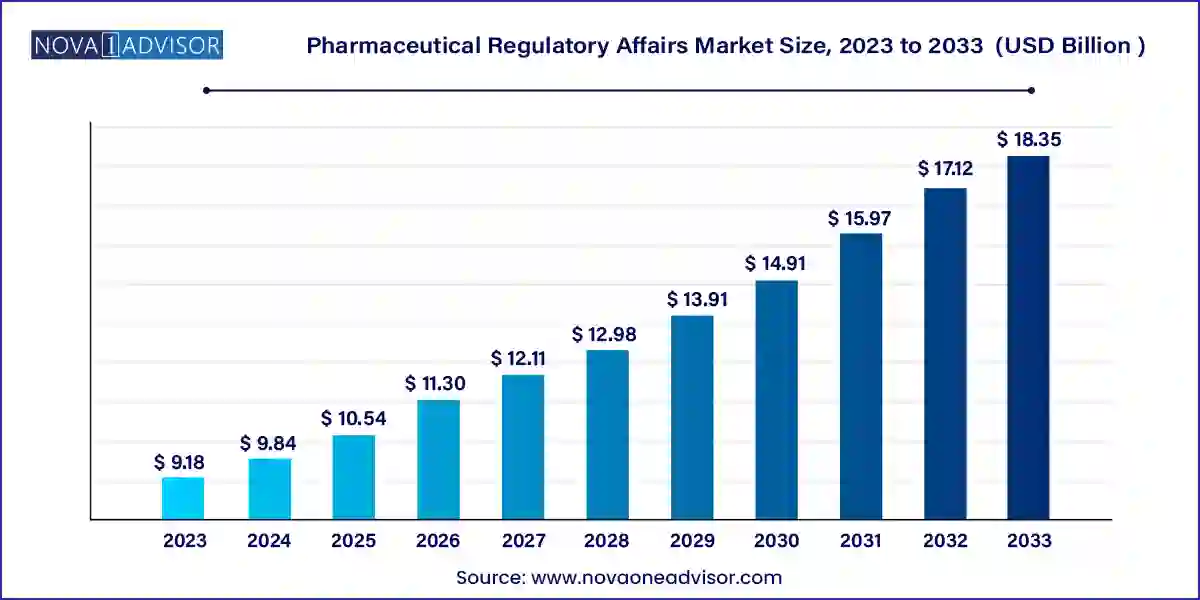

The global pharmaceutical regulatory affairs market size was valued at USD 9.18 billion in 2023 and is anticipated to reach around USD 18.35 billion by 2033, growing at a CAGR of 7.17% from 2024 to 2033.

The pharmaceutical regulatory affairs market plays a vital role in the global healthcare landscape by acting as the bridge between regulatory agencies and pharmaceutical or biopharmaceutical companies. Regulatory affairs professionals ensure that new and existing products comply with the ever-evolving legal, scientific, and administrative standards set by regulatory bodies like the U.S. Food and Drug Administration (FDA), the European Medicines Agency (EMA), and regulatory authorities in Asia-Pacific, Latin America, and the Middle East.

This market is being driven by increasing globalization of pharmaceutical operations, the rising complexity of drug development, and heightened regulatory scrutiny for product safety and efficacy. As more countries establish or reinforce their regulatory frameworks, pharmaceutical companies must adapt their submission strategies and compliance models. Moreover, with the rise in innovative therapies such as advanced therapy medicinal products (ATMPs), cell and gene therapies, and biosimilars, the need for specialized regulatory support has grown significantly.

Regulatory affairs services encompass a broad array of functions including regulatory consulting, dossier preparation, legal representation, clinical trial applications, post-marketing compliance, and lifecycle management. Companies are increasingly turning to specialized providers to manage these functions either in-house or through outsourcing models. This has paved the way for a robust and scalable regulatory ecosystem that supports pharmaceutical and biopharmaceutical innovation from early research through commercialization.

Rising Demand for Regulatory Outsourcing: Pharma companies are partnering with CROs and regulatory affairs service providers to streamline complex regulatory submissions globally.

Integration of AI and Regulatory Tech (RegTech): Digital tools, machine learning, and automation are being deployed for data aggregation, submission tracking, and dossier authoring.

Growing Complexity in Global Compliance: Harmonization of regulations (e.g., ICH, WHO) is progressing slowly, prompting companies to navigate diverse local standards.

Specialization in Biologics and ATMP Regulations: The emergence of gene therapies, CAR-T cell therapies, and mRNA vaccines has led to demand for highly specialized regulatory expertise.

Lifecycle Management and Post-market Surveillance: Ongoing obligations such as pharmacovigilance, risk evaluation, and labeling updates are pushing companies to invest in long-term regulatory support.

Regulatory Strategy in Clinical Trials: Regulatory input is now involved earlier in drug development to reduce delays and optimize clinical trial design.

Rising Regulatory Inspections: Authorities are conducting more inspections to ensure data integrity, increasing the need for audit preparation and compliance documentation.

Emerging Markets Demand Strategic Navigation: Companies expanding into Latin America, India, and Southeast Asia require region-specific strategies to handle documentation, GMP compliance, and registration.

| Report Attribute | Details |

| Market Size in 2024 | USD 9.84 Billion |

| Market Size by 2033 | USD 18.35 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 7.17% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Service provider, service, category, indication, development stage, company size, and region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Freyr, IQVIA Inc, ICON plc, WuXi AppTec (WAI), Charles River Laboratories International, Inc., Labcorp Drug Development, Parexel International Corporation, Pharmalex GmbH, Pharmexon, Genpact |

A primary driver for the regulatory affairs market is the increasing volume of global drug approvals and clinical trials, especially with the surge in complex biologics and combination therapies. The number of Investigational New Drug (IND) applications and New Drug Applications (NDAs) submitted to agencies such as the FDA has risen significantly over the past decade. This increase is driven by pharmaceutical innovation targeting unmet medical needs such as rare diseases, oncology, and neurodegenerative disorders.

With the growing need for regulatory clarity at each development milestone, companies are engaging regulatory affairs professionals much earlier in the drug development lifecycle. Whether navigating the intricacies of EMA’s centralized procedure or ensuring compliance with evolving Health Canada requirements, regulatory strategy is becoming a critical factor in the speed and success of market entry. The role of regulatory affairs is no longer reactive; it is strategic and embedded into cross-functional decision-making from discovery through product launch.

A major challenge that constrains market growth is the complexity and inconsistency in regulatory requirements across different countries and regions. While harmonization efforts like ICH and WHO guidelines have made strides, local authorities still maintain country-specific dossier formats, labeling rules, and clinical trial regulations. For instance, Brazil’s ANVISA, Japan’s PMDA, and India’s CDSCO all have unique documentation requirements that differ from EMA or FDA frameworks.

This lack of regulatory alignment increases the burden on pharmaceutical companies and service providers, resulting in extended timelines and higher operational costs. Constant changes in regional policies—such as Brexit-related shifts in the UK, updates in China’s NMPA process, or new data privacy laws in the EU (GDPR)—add layers of compliance risk and documentation updates. Smaller companies, in particular, may struggle to maintain in-house expertise for global submissions, creating bottlenecks or compliance failures.

A transformative opportunity lies in the digitalization of regulatory affairs through the adoption of Regulatory Information Management (RIM) systems, AI-driven document analysis, and eCTD 4.0 workflows. These tools enable regulatory teams to automate submission tracking, manage product lifecycle data, perform impact assessments, and generate audit-ready documentation with reduced human error.

As authorities like the FDA move toward electronic submissions and cloud-based interfaces, pharmaceutical companies are looking to future-proof their regulatory operations. The integration of predictive analytics for labeling, risk detection, and compliance mapping offers significant value. Regulatory Tech (RegTech) companies that develop modular, secure platforms for real-time compliance management, dossier publishing, and AI-supported decision-making are poised to thrive in this evolving landscape.

In-house regulatory affairs dominated the market in 2023, primarily because large pharmaceutical and biopharmaceutical companies have established internal departments to handle core regulatory functions, especially for high-stakes submissions like Biologic License Applications (BLAs) or Investigational New Drug (IND) applications. These teams are well-integrated with R&D, clinical, and legal departments, ensuring seamless alignment across drug development phases. Moreover, internal ownership over regulatory timelines enables better resource planning and risk mitigation during audits and inspections.

Outsourcing is the fastest-growing service provider segment, driven by the rising complexity of global regulations and the need for cost-effective scalability. Small to mid-sized pharma firms, which may lack in-house regulatory capacity, often outsource document preparation, submission management, and regulatory consulting to specialized service providers. Even large companies are increasingly outsourcing post-market functions such as labeling updates, annual reports, and pharmacovigilance documentation. The flexibility, global reach, and technology-enabled platforms offered by outsourced providers are accelerating this trend.

Regulatory writing and publishing services held the largest market share, as accurate, timely preparation of documents like CTDs (Common Technical Documents), Investigator’s Brochures, and periodic safety update reports (PSURs) is critical to successful submissions. These services also encompass eCTD compliance formatting and data standardization, which are mandatory for electronic submissions to global regulatory agencies.

Regulatory consulting is the fastest-growing segment, reflecting a broader strategic role being played by regulatory affairs professionals. Companies are engaging consultants for clinical trial planning, accelerated approval strategies, orphan drug designations, pediatric study planning, and regional regulatory intelligence. The value of early-stage regulatory input in optimizing trial design and reducing approval timelines is being widely recognized.

Drugs – innovator drugs were the dominant category due to the higher volume of new chemical entities (NCEs) entering development pipelines. Regulatory submissions for innovator drugs involve multiple phases including preclinical safety packages, clinical trial applications, and extensive post-approval monitoring.

Biologics – particularly ATMPs and biosimilars – represent the fastest-growing segments. Regulatory complexity and need for product-specific guidance for ATMPs like CAR-T therapies, as well as biosimilarity assessment requirements for biosimilars, are driving specialized regulatory services. The demand for regulatory professionals with expertise in biologics, comparability protocols, and CMC (chemistry, manufacturing, and controls) submissions is rising sharply.

Oncology remained the leading indication for regulatory affairs services, accounting for a large number of new IND filings, breakthrough designations, and accelerated approval pathways. Oncology products often require rolling submissions, adaptive trial designs, and companion diagnostic clearances—all of which require close regulatory guidance.

Immunology and neurology are among the fastest-growing indications, spurred by advances in autoimmune therapy, neurodegenerative disease treatment, and vaccine development. These fields are generating new mechanisms of action and novel delivery technologies, each requiring complex regulatory navigation and strategic communication with agencies.

Clinical stage services dominated the regulatory affairs market, as most submissions and interactions with agencies occur during Phases I–III. Regulatory involvement includes protocol approvals, IND maintenance, safety reporting, and trial design amendments.

Post-market approval (PMA) services are growing rapidly, especially in the context of product lifecycle management. Activities like pharmacovigilance, annual reporting, post-marketing surveillance studies, and REMS (Risk Evaluation and Mitigation Strategies) contribute significantly to long-term compliance obligations.

Large pharmaceutical companies led the segment, owing to their diversified pipelines, global presence, and established in-house regulatory affairs divisions. They also engage in lifecycle management for vast product portfolios, requiring sustained regulatory attention.

Small and medium-sized enterprises (SMEs) are the fastest-growing users, as they increasingly invest in drug discovery and require external regulatory expertise. With limited internal resources, these firms depend on CROs and regulatory consultancies to manage regulatory filings, clinical trial applications, and agency communication.

North America, particularly the United States, held the largest share in 2023, thanks to a robust pharmaceutical industry, early adoption of digital regulatory solutions, and a well-structured regulatory ecosystem. The FDA’s leadership in promoting eCTD, real-world evidence (RWE), and accelerated approval frameworks has made the U.S. a complex but rewarding regulatory environment. The presence of top pharmaceutical companies, CROs, and consulting firms, coupled with high regulatory literacy, ensures continued regional dominance.

Asia-Pacific is the fastest-growing region, driven by rising clinical trial activity, increasing local drug innovation, and a gradual modernization of regulatory systems in China, India, and Southeast Asia. Regulatory reforms like China's MAH (Marketing Authorization Holder) system, India's New Drugs and Clinical Trials Rules, and ASEAN regulatory harmonization efforts are making the region more attractive for global market entry. Local players and MNCs alike are investing in regulatory expertise to tap into Asia-Pacific’s expanding patient base and cost-effective manufacturing capacity.

The following are the leading companies in the pharmaceutical regulatory affairs market. These companies collectively hold the largest market share and dictate industry trends.

March 2024 – Parexel expanded its regulatory consulting capabilities in Asia-Pacific through a new hub in Singapore focused on early-stage regulatory strategy and global filings.

February 2024 – IQVIA launched a Regulatory Intelligence Platform (RIP) integrated with AI, aimed at predicting submission timelines and identifying regional documentation gaps.

January 2024 – ICON plc announced a partnership with a biotech startup to manage global regulatory strategy for an ATMP product entering Phase I trials.

December 2023 – Certara acquired a small regulatory publishing firm to bolster its eCTD submission services across Europe and Latin America.

November 2023 – Syneos Health launched a Regulatory Affairs-as-a-Service (RAaaS) platform for small and mid-sized biotech firms, offering end-to-end virtual regulatory operations.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Pharmaceutical Regulatory Affairs market.

By Service Provider

By Service

By Category

By Indication

By Development Stage

By Company Size

By Region